Background

The point system is a reward mechanism that allows consumers to earn points equivalent to a certain amount when they purchase products or services, aiming to enhance customer loyalty and encourage repeat purchases.

Recently, this point system has been digitized into a mobile point system. However, small business owners running individual shops often face financial burdens in adapting to these changes. The SMTP token is designed to address these challenges.

Limitations of the Point System for Small Businesses

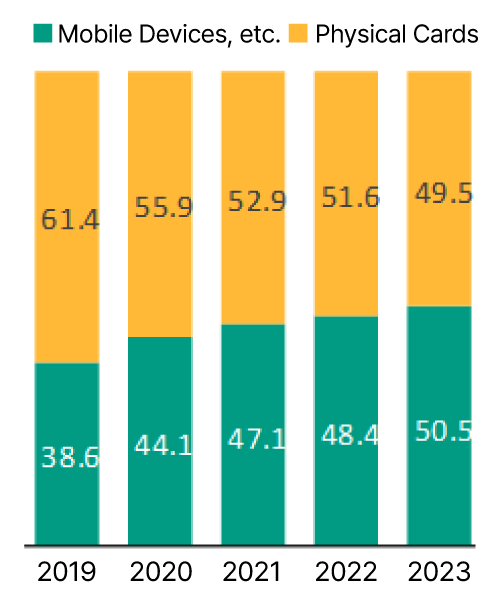

In 2023, mobile payments reached 1.4740 trillion won, accounting for 50.5% of total payment transactions. For the first time, the amount paid via mobile devices such as smartphones and smartwatches surpassed that of physical card payments.

<Figure 1. Payment ratio trend by access device>

<Figure 1. Payment ratio trend by access device>

Source: Credit Card Companies

According to the Bank of Korea's report on "The Status of Electronic Payment Services in the First Half of 2024," released on September 23, the average daily transaction amount for simple payment services in the first half of this year was 939.2 billion won, marking the highest level since statistics began in 2016.

As mobile payment usage continues to rise, point systems are evolving in response to changes in payment methods. While large franchises actively adopt various services, including digital coupons, small business owners face high development and system maintenance costs, making it difficult for them to push for mobile integration. As a result, many offline stores still rely on paper coupons, which puts them at a disadvantage in competition with franchises that have digitized their point systems. This reality poses limitations on the current social structure aimed at fostering mutual growth.

Limited Use of Points

Most stores operate a points accrual system that only allows points to be used once a certain threshold is reached, often requiring additional steps such as app installation or identity verification. Furthermore, points typically have an expiration date, and consumers often lose their accumulated points if they do not use them within the given period.

<Figure2. Status of points that are lost every year, approximately 100 billion won>

<Figure2. Status of points that are lost every year, approximately 100 billion won>

As card usage increases, the total amount of accumulated points has also steadily risen, but a significant amount of points expire each year. According to the Financial Supervisory Service, the annual average of expired points from eight major credit card companies between 2017 and 2022 was approximately 104.2 billion won. Most card points have a validity period of five years, and unused points often expire.

In response to this issue, a ‘Unified Card Point Inquiry’ service has been introduced, allowing users to check their accumulated points across various card companies. However, since points are still accumulated separately by each card company, the process of consolidating and converting points into cash remains cumbersome, leaving room for further improvement.

Ownership Issues with Points

Points can be considered a form of property, as they are rewards earned by consumers for purchasing products or services. However, many companies enforce policies that restrict the transfer of points between consumers, citing reasons such as preventing fraudulent use and protecting brand value. As a result, consumers are often unable to freely utilize the points they have accumulated, diminishing the overall value of these points from the consumer's perspective.

Resolving Post-Purchase Disputes

In online commerce, it is common for consumers to forget the store where a product was purchased or to find that the seller has stopped operating after some time. In such cases, there is often no way to verify payment records, leaving consumers with significant limitations when attempting to receive after-sales services.